Stock Screening Tools

These are tools to help you find (real-life) companies based on your selection criteria. For example, you could prefer large companies that have a dividend yield above 4%.

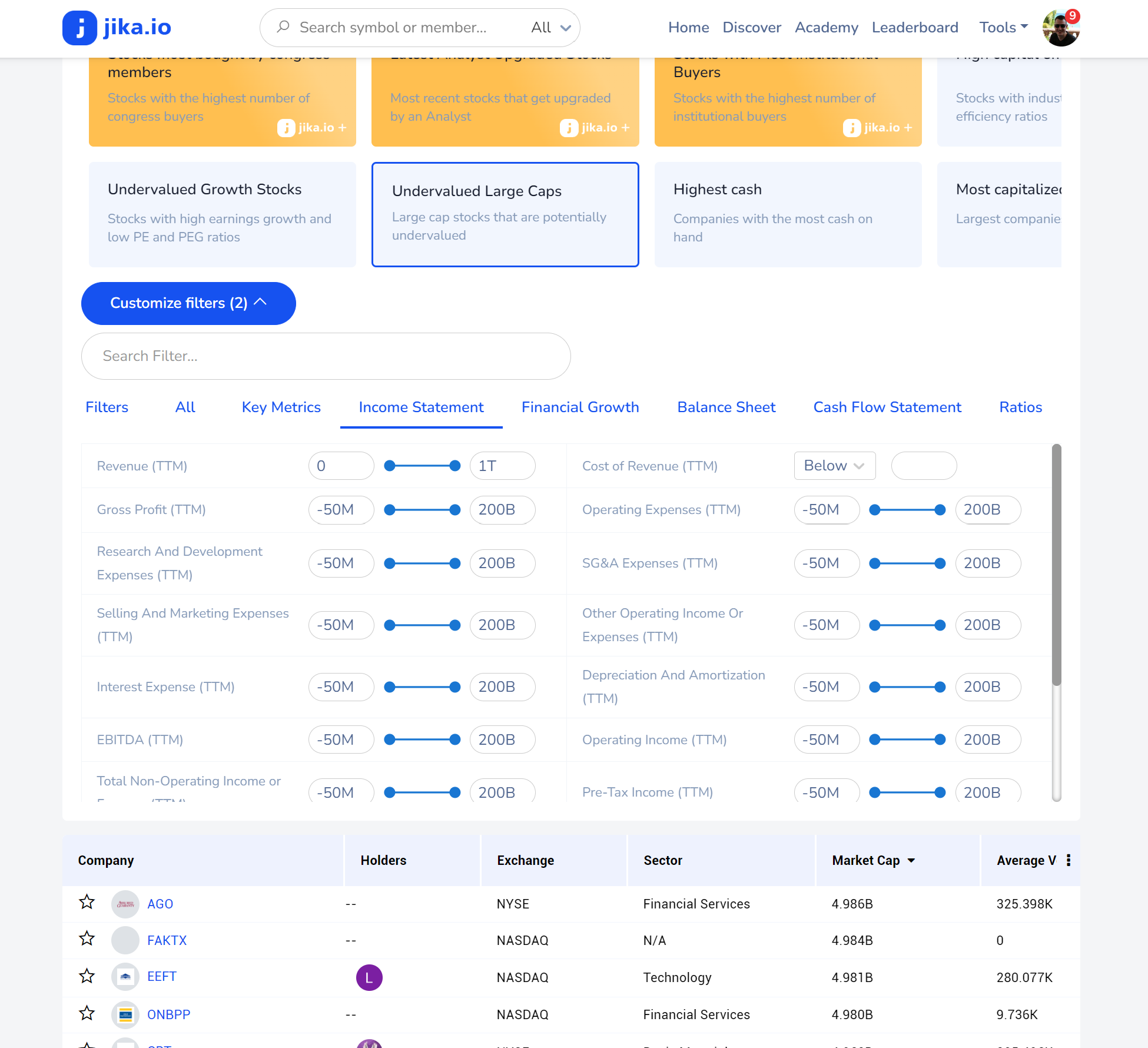

Jika.io Stock Screener

- Website: Jika.io Stock Screener

- Description: Jika.io offers a comprehensive stock screener that allows investors to filter stocks based on various parameters such as market capitalization, sector, price-to-earnings ratio, and more. It provides advanced filtering options and customizable screens to help investors identify potential investment opportunities.

TradingView Stock Screener

- Website: TradingView Stock Screener

- Description: TradingView offers a powerful stock screener tool that enables users to screen stocks based on technical indicators, fundamental metrics, and custom criteria. It provides interactive charts, real-time data, and extensive customization options to suit the needs of both novice and experienced traders.

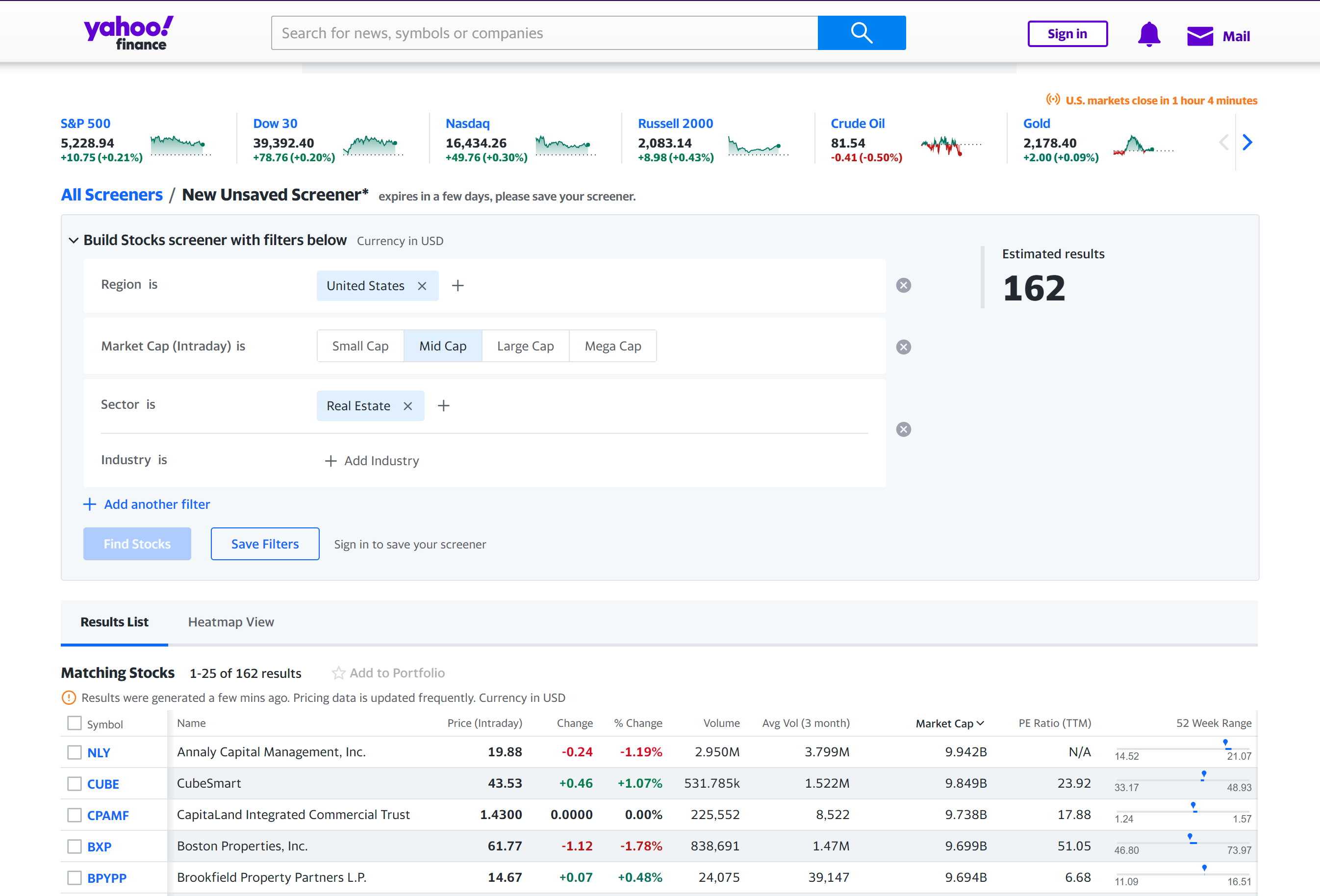

Yahoo Finance Stock Screener

- Website: Yahoo Finance Stock Screener

- Description: Yahoo Finance provides a user-friendly stock screener tool that allows investors to filter stocks based on key fundamental metrics, including market cap, dividend yield, price-to-earnings ratio, and more. It offers pre-defined screens and customizable filters to help investors identify stocks that align with their investment strategies.

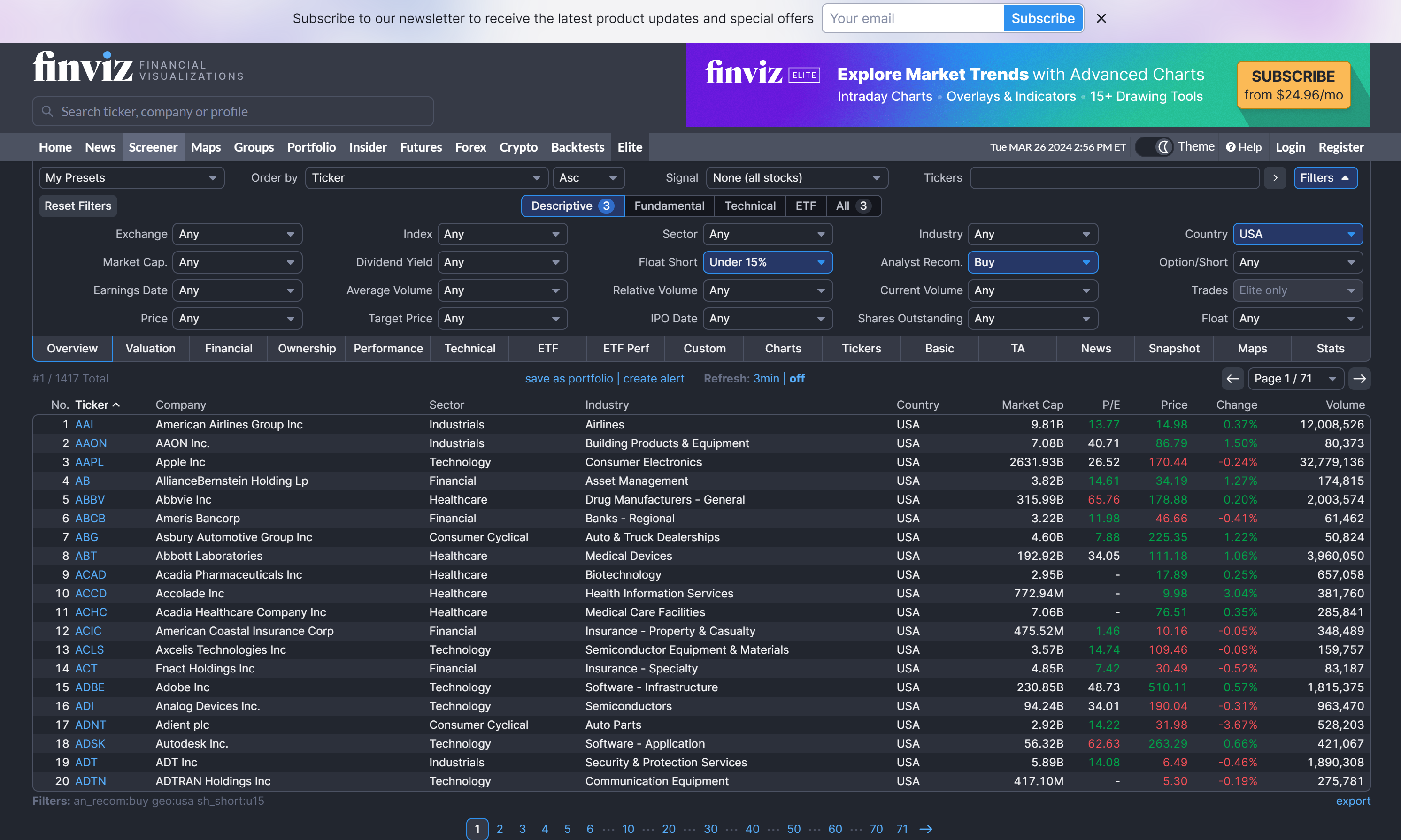

FINVIZ Stock Screener

- Website: FINVIZ Stock Screener

- Description: FINVIZ offers a comprehensive stock screener tool with advanced charting capabilities and customizable filters. It allows users to screen stocks based on technical patterns, fundamental data, and performance metrics. Additionally, FINVIZ provides heat maps and visualization tools to aid in stock selection and analysis.

What is a Stock Screener?

A stock screener is a software tool that sorts through a large database of stocks to find ones that match the user's defined parameters. These parameters can include financial metrics like price-to-earnings ratios, market capitalization, dividend yields, and many others.

Why Use A Stock Screener?

- Precision Targeting: Find stocks aligned with your strategy, instead of browsing randomly.

- Save Time: Avoid endless scrolling and manual research on individual companies.

- Discover Hidden Gems: Uncover stocks overlooked by the crowd.

- Test Your Ideas: Backtest how certain criteria would've performed in the past.

Use Cases Examples

- To find stocks that are potentially cheaper than they should be by looking at how much money the company makes compared to its stock price, how much its assets are worth, or how much money it makes from selling stuff.

- To find stocks from companies that are growing quickly, making more money, selling more stuff, or earning more profit.

- To look for stocks from companies that regularly pay out some of their profits to their shareholders as a reward for investing in them, and these payments have been growing over time.

- To pick stocks that look good based on certain signs in their price charts, like if they're moving up smoothly, or if they're in a strong position compared to other stocks.

- To choose stocks from certain types of businesses or industries that match what you're interested in or believe will do well in the future.

- To find companies that are financially strong, don't owe too much money, and are making more money than they're spending.

- To see which stocks experts think are good investments or which ones big companies recommend buying.

- To look for stocks from companies that care about things like the environment, being fair to workers, or being honest with their customers, which is important to some investors.

- To find stocks that don't change in price too much, which might be safer for people who don't want to take big risks with their money.

- To see which stocks are being bought a lot by the people who work for the company, which could mean they believe the company will do well in the future.